On August 25, 2022, the Securities and Exchange Commission (SEC) adopted pay versus performance disclosure rules that will require public companies to provide extensive information that is intended to demonstrate the relationship between the executive compensation that is actually paid by a company and the company’s overall financial performance. The adoption comes 12 years after Congress directed the SEC to implement pay versus performance disclosure rules pursuant to Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. According to the SEC, the rules are intended to provide investors with more transparent, readily comparable, and understandable disclosure of a company’s executive compensation so that investors may better assess a company’s executive compensation program when making voting decisions.

Public companies must comply with the rules (which became effective on October 11, 2022) in proxy and information statements that are required to include executive compensation information pursuant to Item 402 of Regulation S-K for fiscal years ending on or after December 16, 2022. The rules allow for scaled disclosure from smaller reporting companies (SRCs) and do not apply to foreign private issuers, registered investment companies, or emerging growth companies.

The disclosure requirements are implemented in a new paragraph (v) of Item 402 of Regulation S-K. Pursuant to Item 402(v), any proxy statement or information statement that requires executive compensation disclosure must include the following:

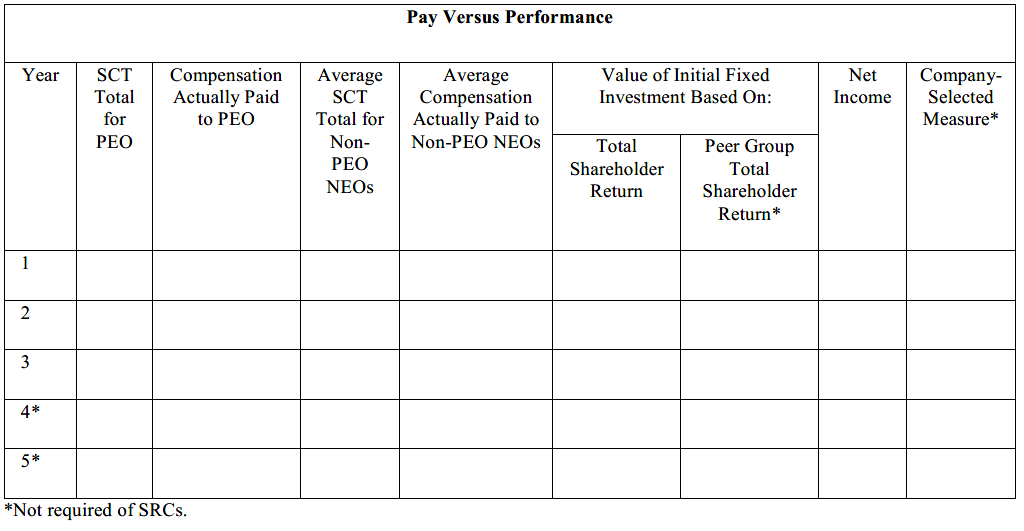

- A table, in the form prescribed by the rules and shown below, containing pay versus performance information for the five most recently completed fiscal years. In the first proxy or information statement in which the disclosure is required, companies (other than SRCs) must provide information for the three most recently completed fiscal years, with another year to be added in each of the next two succeeding annual proxy or information statements filed. SRCs only need to provide information for the two most recently completed fiscal years in the first proxy or information statement in which the disclosure is required, after which they will need to provide information for the three most recently completed fiscal years in successive proxy and information statements. The required disclosure, in the tabular format shown below, is of the following information and metrics:

- The total compensation amount shown in the summary compensation table (SCT Total) for, and the executive compensation actually paid (using a prescribed formula that includes adjustments for pension benefits and equity awards) to, the principal executive officer (PEO); and the average SCT Total for, and the average compensation actually paid to, the company’s other named executive officers (NEOs). SRCs are not required to consider pension benefits as part of the executive compensation actually paid.

- The company’s cumulative total shareholder return (TSR) (substantially as defined in Item 201(e) of Regulation S-K), the TSR of a peer group chosen by the company (which can be the industry peer group identified by the company in Item 201(e) or the peer group identified in the company’s Compensation Discussion and Analysis section of Item 402(b) for the purpose of disclosing the company’s compensation benchmarking practices), the company’s net income, and a financial performance measure not otherwise required to be disclosed in the table but that the company believes is the most important measure for the purpose of linking the executive compensation actually paid with the company’s financial performance during the most recently completed fiscal year (the Company-Selected Measure). Company-Selected Measures may be non-GAAP financial measures. Companies can choose a different Company-Selected Measure in the next proxy or information statement in which the disclosure is required. SRCs are not required to present peer group TSR or provide a Company-Selected Measure.

- In addition to the tabular disclosure, companies must clearly describe, in narrative and/or graphic form, the relationship between the executive compensation actually paid and the company’s financial performance, as well as the relationship between the company’s TSR and the peer group TSR. SRCs only need to provide descriptions for the measures that they must include in the tabular disclosure.

- Companies must also provide an unranked tabular list of three to seven financial performance measures that they believe are the most important measures for the purpose of linking the executive compensation actually paid to the NEOs to the company’s financial performance during the most recently completed fiscal year. The list must include the Company-Selected Measure. Companies may also include nonfinancial performance measures, such as environmental, social, and governance criteria, in the list if applicable. Companies may provide one list including all NEOs; two lists, with one for the PEO and one for all other NEOs; or separate lists for each NEO. SRCs are not required to provide the list.

- Companies may voluntarily provide supplemental information that addresses the issue of pay versus performance so long as it is identified as being supplemental and is not misleading in nature.

- Companies must tag the information using Inline eXtensible Business Reporting Language (XBRL). SRCs will not need to tag the information until their third proxy or information statement that is required to include disclosure under the rules.

As public companies will need to comply with these disclosure requirements in proxy and information statements filed on or after December 16, 2022, companies should begin to consider when they will first need to comply with the new rules. Those companies whose fiscal year-end is the end of the calendar year will need to comply with the new requirements in the proxy statements or information statements filed in the 2023 proxy season and, therefore, should begin to prepare by considering what financial performance and executive compensation information they will be required to disclose, what information they should choose to disclose (including the Company-Selected Measure and the unranked list of performance measures), which peer group should be selected, how to calculate the executive compensation actually paid, the extensive amount of time and work that will be required in order to compile and confirm all of the information, how to appropriately present the information (including tabular format, narrative, and XBRL), where to place the information within their statements, how to clearly describe the relationship between executive compensation and financial performance, and whether supplemental information should be voluntarily included.

Any questions may be directed to any of the following: Veronica H. Montagna, Michele F. Vaillant and Matthew A. Windman.

Related media coverage of this issue includes: