Congress is proposing much-needed relief for restaurants devastated by the COVID-19 pandemic. The foodservice industry employs 10% of the U.S. workforce, and forced closures of restaurants have had a ripple effect on farmers, fishermen, distributors, and truckers that rely on them. Restaurants across the country are being required by health regulations to significantly limit their “in house” dining capacity, forcing them to increasingly rely on takeout and delivery. Under these conditions, many will not survive the year without government assistance.

Bipartisan Bills Propose $120 Billion in Relief for Foodservice Industry

The “Real Economic Support That Acknowledges Unique Restaurant Assistance Needed To Survive Act of 2020,” or the “Restaurants Act of 2020,” would establish a $120 billion fund to be administered by the U.S. Treasury (the “Fund”) for structured relief to foodservice or drinking establishments through December 31, 2020. See Senate bill S. 4102 and House of Representatives bill H.R. 7197. Any amounts remaining in the Fund after December 31, 2020, would be deposited in the general fund of the Treasury.

Eligible Businesses

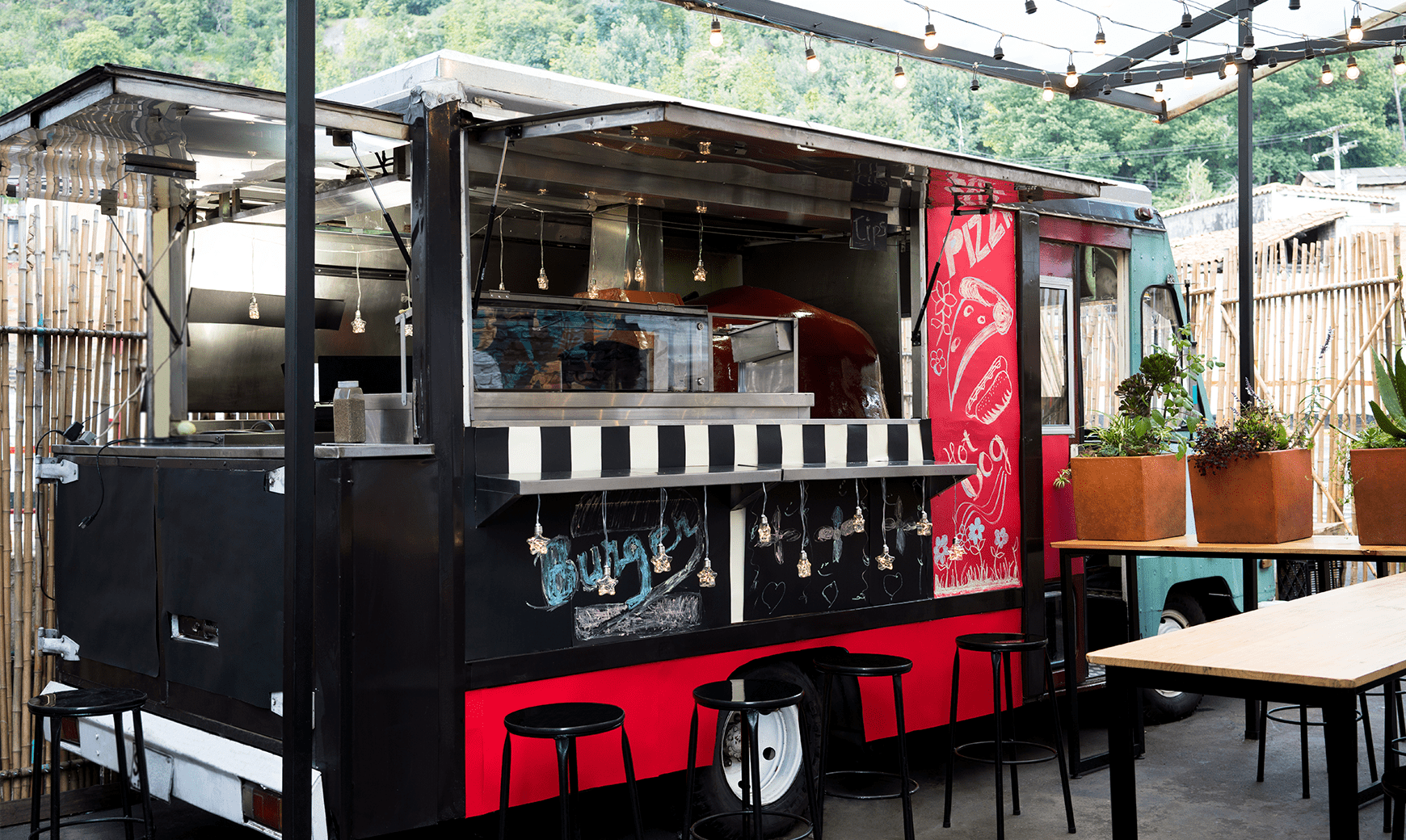

Businesses eligible for a grant under the Fund would be restaurants, food stands, food trucks, food carts, caterers, saloons, inns, taverns, bars, lounges, and other similar places of business in which the public or patrons assemble for the primary purpose of being served food or drink, that as of March 13, 2020, were not (a) part of a chain or franchise with more than 20 locations doing business under the same name, regardless of the type of ownership of the locations; (b) publicly traded, including a subsidiary or affiliate thereof; or (c) part of a state or local government facility other than an airport. An eligible business may receive only one grant.

Permitted Use of Grant Proceeds

From February 15, 2020, and ending on December 31, 2020 (the “Covered Period”), eligible businesses can receive a grant for proceeds to be used for the following:

(A) payroll costs;

(B) payments of principal or interest on any mortgage obligation;

(C) rent payments, including rent under a lease agreement;

(D) utilities;

(E) maintenance, including construction to accommodate outdoor seating;

(F) supplies, including protective equipment and cleaning materials;

(G) food and beverage;

(H) debt obligations to suppliers that were incurred before the covered period; and

(I) any other expenses that Treasury determines to be essential to maintaining the eligible entity.

Determining Grant Amount

The amount of a grant will be determined by the difference in revenues or estimated revenues of the eligible business during a calendar quarter in 2020, selected by the business, as compared with the same calendar quarter in 2019. An eligible entity shall submit to Treasury such revenue verification documentation and additional documentation as Treasury may require.

Reduction Based on Economic Injury Disaster Loan or Paycheck Protection Program Forgiveness

If an eligible business has received an Economic Injury Disaster Loan under section 1110(e) of the CARES Act (“EIDL”) or Paycheck Protection Program loan forgiveness under section 1106 of such Act (“PPP”) related to and duplicative of the expenses incurred during the Covered Period, the maximum amount of a grant awarded to the eligible entity will be reduced by the amount of funds expended by or forgiven for the eligible entity for those duplicative expenses using amounts received under such section 1110(e) or forgiven under such section 1106. Accordingly, an eligible business should be able to avoid any reduction by demonstrating that the grant will not cover those expenses already addressed by an EIDL or PPP. In that way, the grant can pick up where the EIDL or PPP ended.

Applying for Grant

Treasury will award grants to eligible entities in the order in which applications are received. During the initial 14-day period in which Treasury awards grants under this section, it will:

(A) prioritize awarding grants to marginalized and underrepresented communities, with a focus on women- and minority-owned and -operated eligible businesses; and

(B) award grants only to eligible entities with annual revenues of less than $1.5 million.

Repayment of Grant

Any grant amount not used during the Covered Period will be converted into a loan. In addition, should the estimated revenue for the selected 2020 quarter for which the grant amount was determined exceed the actual revenue for such quarter, the excess will be converted into a loan. These loans will have:

(A) an interest rate of 1 percent; and

(B) a maturity date of 10 years, beginning on January 1, 2021.

Should a grant recipient permanently go out of business on or before December 31, 2020, it must return any funds not used for permitted uses.

Taxability of Grant

Grant amounts will be taxed as follows:

- the amount of a grant awarded to an eligible entity is excluded from the gross income of the eligible entity;

- the exclusion from gross income will not result in the reduction of any tax deduction, tax attribute or any basis increase; and

- an eligible entity that receives a grant cannot qualify for the payroll tax credit of up to $5,000 per employee in respect of 50% of wages up to $10,000 paid from March 12 to December 31, 2020 (Section 2301 of the CARES Act).

Set Aside

Treasury would be required to set aside from its general budget $60 million for staff and administrative expenses for outreach to traditionally marginalized and underrepresented communities, with a focus on women-, veteran-, and minority-owned and -operated eligible entities, including the creation of a resource center that targets these communities.

McCarter & English, LLP, is closely monitoring this relief for the foodservice industry and will provide further guidance on the Restaurants Act of 2020 as it becomes available.

Related media coverage includes the article below: