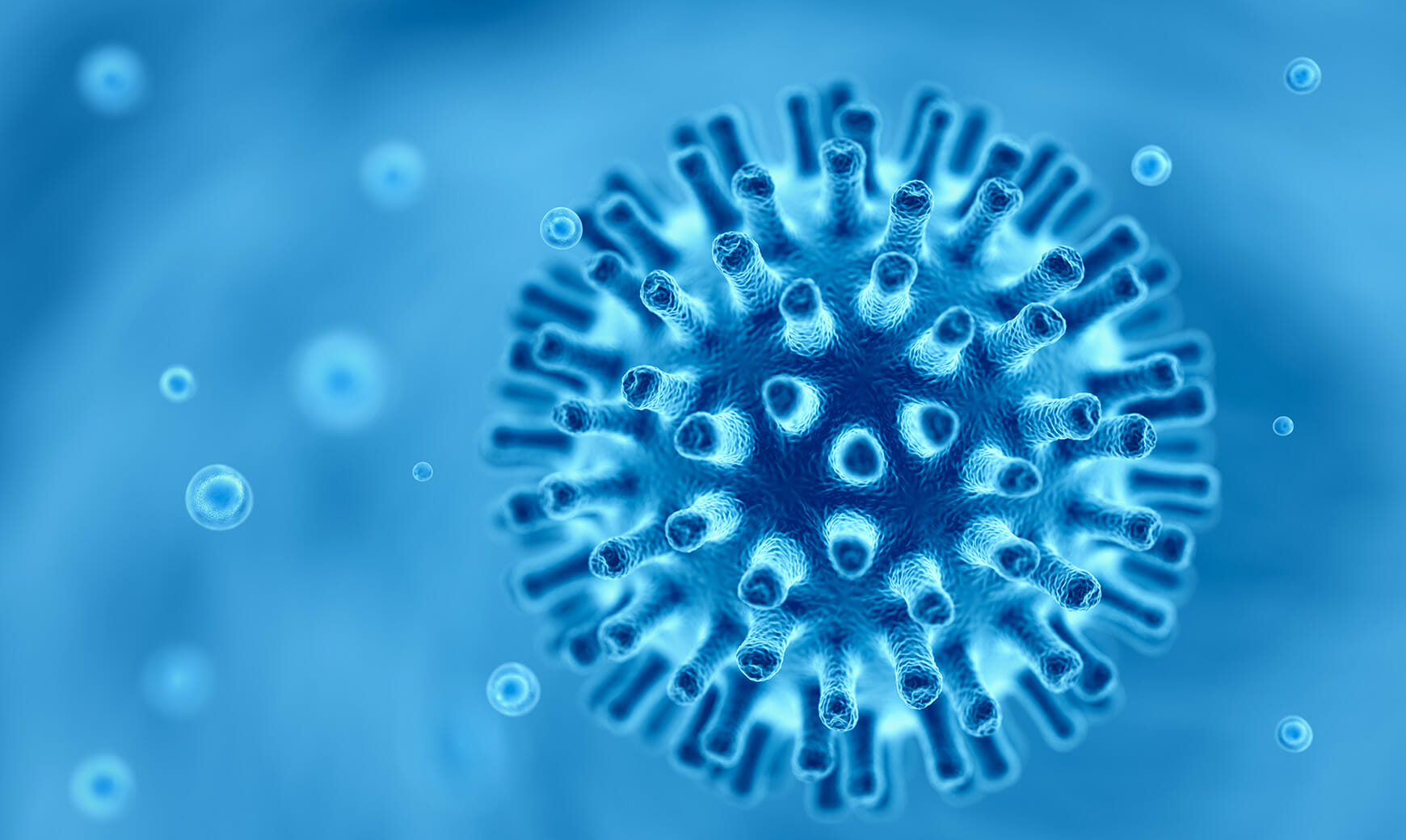

McCarter & English lawyers are monitoring the evolving regulatory implications of the COVID-19 pandemic. Click below for the latest news on how it impacts businesses.

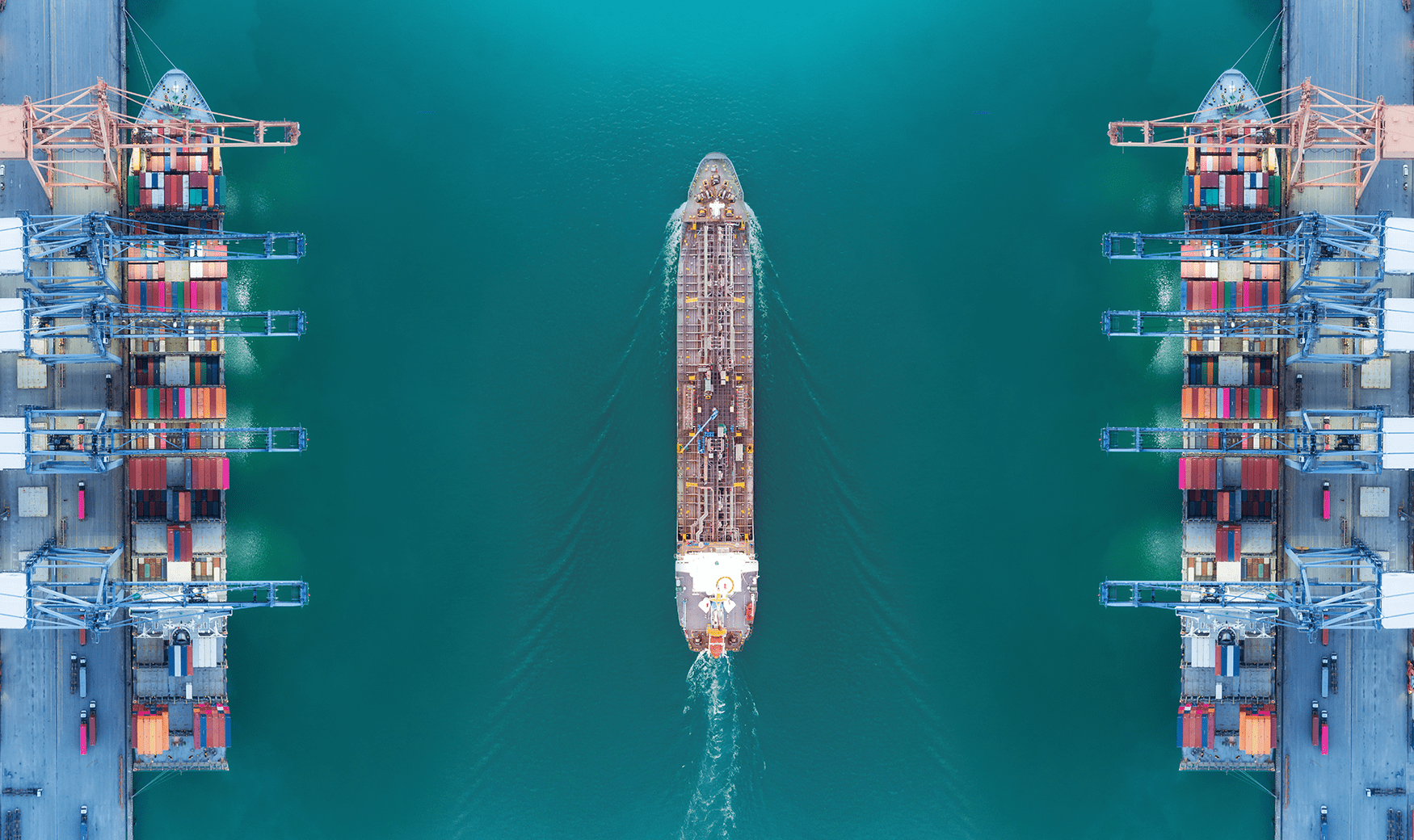

Business Operations & Supply Chain

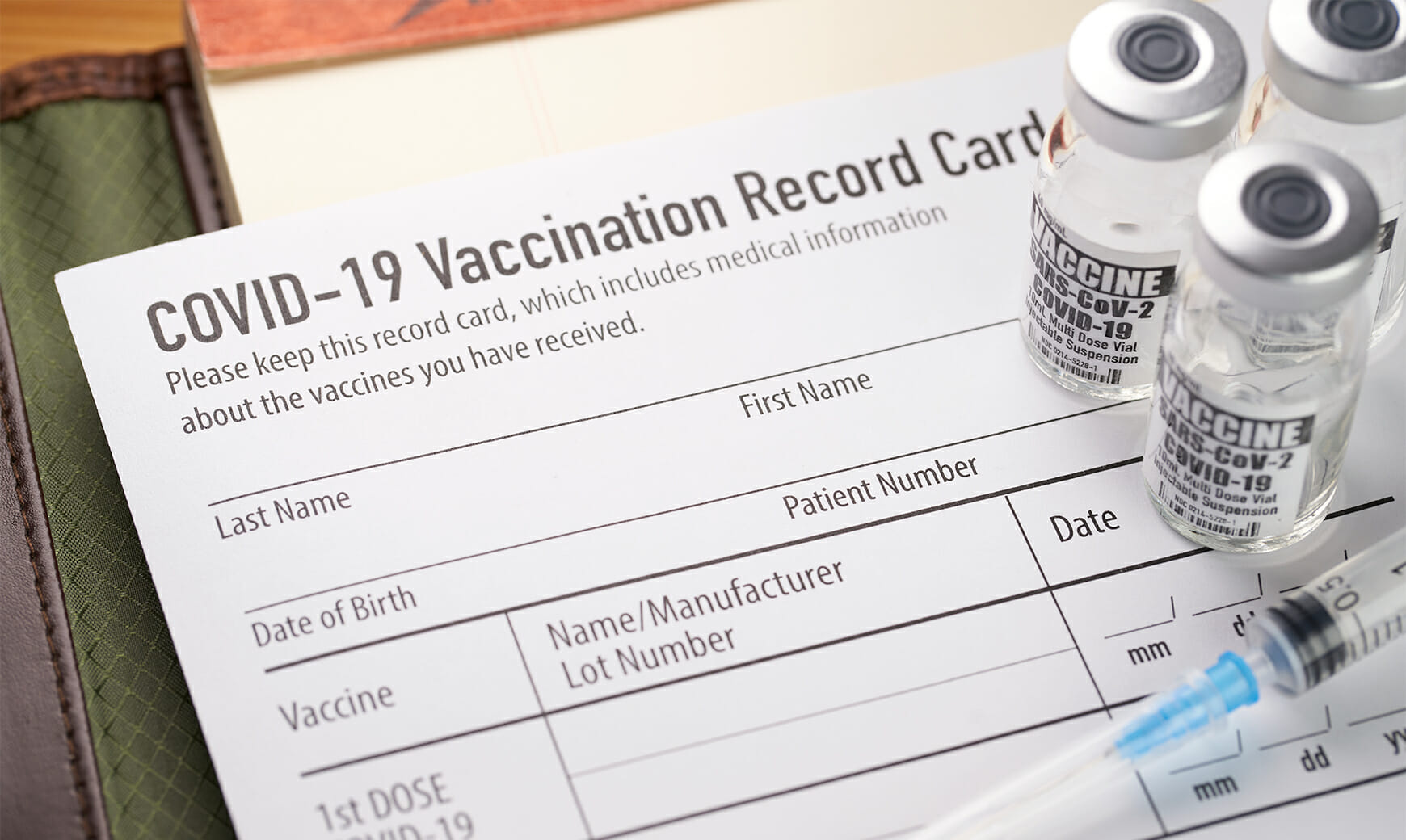

OpenThis Will Only Hurt a Bit: The GSA Mandates COVID-19 Vaccines in Nearly All Existing Contract Types

Supply Chain Resiliency Post-COVID-19

Ten Key Leasing Considerations Resulting from the COVID-19 Pandemic

Negotiating Purchase and Sale Agreements During the COVID-19 Pandemic

Managing the Unimaginable: COVID-19 and Impacts on the Supply Chain

Previous Webinar:

Employment & Workforce Issues

OpenThe Supreme Court Has Stayed OSHA’s Vaccine-or-Test Emergency Temporary Standard. Now What?

CMS Issues a Vaccine Mandate for Certain Health Care Providers

OSHA’s Emergency COVID-19 Vaccination Rule Is Here

Important Updates on Federal Contractor Vaccine Mandate—Deadline Extended and Flexibility Added

This Will Only Hurt a Bit: The GSA Mandates COVID-19 Vaccines in Nearly All Existing Contract Types

Should Employers Resume Voluntary FFCRA Leave Due to Delta Variant?

New Federal “Mandates” for COVID-19 Vaccination: What Do Employers Need to Know Now?

Vaccine Mandates Come with Risks to Employee Pool

So, Can I Make My Employees Get Vaccinated Yet?

A Rush to Rule: More Trump-Era Agency Actions Destined for a Loss in Federal Court

Sweeping Amendment to the New Jersey WARN Act Takes Effect in July

U.S. Immigration and Employment Interruption Guidelines

Leave in the Time of COVID-19: Tracking Employee Leave under the FFCRA and the FMLA

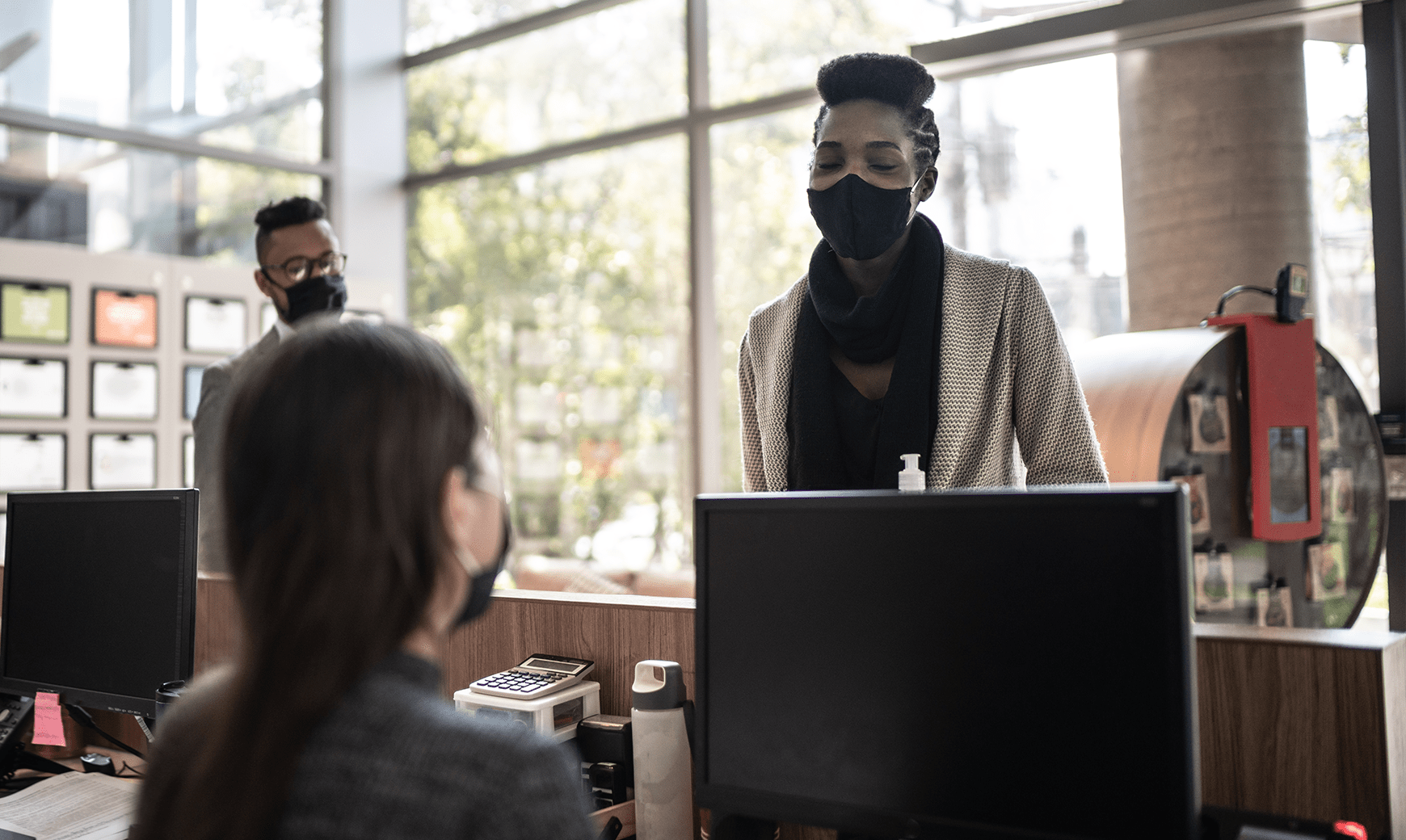

Managing the Workforce During a Pandemic

COVID-19 Labor & Employment Frequently Asked Questions

Businesses Monitor Risks Outside of 9 to 5

U.S. Entry Restrictions and Immigration Update

Previous Webinars:

Ask the Attorneys: Your Reopening, Workplace Safety, and Remote Work Questions Answered (9.15.20)

The ADA and Accommodating Disabilities in the Workplace In The Time of COVID-19 (7.30.20)

Understanding Obligations under the ADA: Your COVID-19 Questions Answered (6.25.20)

Employee Safety in the Covid 19 World (5.28.20)

Remote Work in the Age of COVID-19: Pitfalls and Best Practices (5.21.20)

Worker Activism and Union Organizing During and After COVID-19 (5.14.20)

Managing Employee Attendance During and After COVID-19 (5.7.20)

Litigation & Risk Management

OpenInsurance Recovery, Litigation & Counseling Update

Courts Find Coverage for COVID-19 Business Interruption Losses

Court: COVID-19 Is a Natural Disaster

Proving the Presence of Covid-19 Is a Path to Insurance Coverage

Insurance Considerations and Recovery Strategies

Does Your Contract Protect You from the Coronavirus?

Previous Webinar:

Will Insurance Cover Economic Loss Resulting From the Coronavirus?

Managing Liquidity & Transactional Support

OpenEnhanced Opportunities to Benefit from the Employee Retention Credit

Chapter 11 Debtors with Confirmed Plans Are Now Eligible for PPP Loans

SBA’s Guidance on the $28.6 Billion Restaurant Revitalization Grant Program

What a Business Needs to Know about the Shuttered Venue Operators Grant Program

Business Owners Needing Liquidity: Check Out the “Improved” SBA EIDL Program!

New PPP Rules Benefit Self-Employed Individuals

PPP 2.0 Changes to Prioritize Underserved Small Businesses

Employee Benefits Provisions of the Consolidated Appropriations Act, 2021

Paycheck Protection Program 2.0: What Small Businesses Need to Know

Attention Restaurants! Additional Financial Relief Is Coming.

Confusion Mounts Regarding Bankruptcy Debtor Access to PPP

A PPP Lender’s Dilemma: What to Do If a PPP Loan Is in Default?

Walking Through the Shadows of Bankruptcy: Financing Equipment in Times of Distress

Flexibility Act Significantly Improves the Paycheck Protection Program

Main Street Lending Program Expanded by Federal Reserve

SBA and Treasury Department Sued Over PPP Loan Guidance on the Good Faith Necessity Certification

Congratulations, You Got Your PPP Funds! Now What?

Other SBA Loan Programs for Small Businesses During the Pandemic: The 7(a) Loan Program

SBA Issues New Guidance On “Necessity” Certification In PPP Loan Application

New Developments on PPP Lending

IRS and PBGC Issue Relief Extending Certain Employee Benefit Plan Deadlines Due to COVID-19 Pandemic

Remote Notarizations Temporarily Authorized in New Jersey During Coronavirus Pandemic

IRS Issues Guidance on Key Business Tax Provisions of CARES Act

Borrowers Beware: GAO Ramps Up Efforts to Root Out Fraud Among PPP Loan Recipients

Revisions to New Jersey Statute Permit Virtual Shareholders’ Meetings in COVID-19 Times

Additional Guidance on SBA’s Paycheck Protection Program

Other SBA Loan Programs for Small Businesses During the Pandemic: The SBA 504 Loan Program

Paycheck Protection Program Eligibility Requirements Clarified

Nonqualified Deferred Compensation Plan Sponsors: COVID-19 Pandemic Considerations

Attention Mid-Sized Businesses: Financial Relief Is Coming for You Too!

Affiliation Rules and the Paycheck Protection Program

SBA’s Paycheck Protection Program and Other SBA Relief for Small Businesses Provided in CARES Act

CARES Act Implements Changes to the Tax Code; Provides Economic Relief in the War against COVID-19

Employee Benefit Provisions of the CARES Act

Overview of SBA Loan Programs Available During the COVID-19 Pandemic

Regulatory Guide to Federal, State & Local Requirements

OpenImportant Updates on Federal Contractor Vaccine Mandate—Deadline Extended and Flexibility Added

This Will Only Hurt a Bit: The GSA Mandates COVID-19 Vaccines in Nearly All Existing Contract Types

What’s Next for Federal Contractors and Mandatory COVID-19 Safety Protocols

SBA Revisions Expand Paycheck Protection Program Eligibility and Loan Forgiveness

Confusion Mounts Regarding Bankruptcy Debtor Access to PPP

A PPP Lender’s Dilemma: What to Do If a PPP Loan Is in Default?

Gambling on Compliance? DOJ Updates the House Rules on Corporate Compliance Program Expectations

DoD Issues Draft Guidance for Contractor Reimbursement Under Section 3610 of the CARES Act

DoD Extends a Hand to Federal Contractors Navigating the Impacts of COVID-19